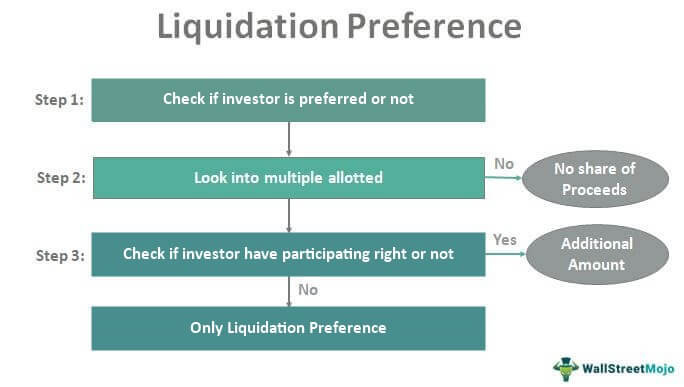

Non-participating preference (1x or multiple): often times referred to as “straight preferred”

at exist investors can either choose between a return of capital (could be partial) and participation with the common shareholders in proportion to their ownership

If investors end up choosing a return of their capital, the remaining proceeds are divided among common shareholders

Example:

$25m investment with a 1.2x liquidation preference multiple (implies that the company must redeem the obligation at no less than 1.2* $25m = $30m at exit if the investors choose not to convert to common stock)

Any remaining proceeds flow down to the common shareholders

Had the investors chosen to convert, their preferred shares would turn into common shares at the pre-determined ‘conversion-ratio’ and they would share proceeds pro rata with the common shareholders

Participating 1x liquidation preference: often times referred to as “participating preferred”, “full participating preferred”, “double dipping”

Investors first receive their capital (1x preference) and then their shares convert to common

First capital is returned to the preferred investors

Then the gains from the sale are distributed pro rata to ownership, but including the preferred investors on the second distribution on an as-converted basis

Example:

$10m post-money valuation with a VC having invested $5m

Firms sells for $30m with a 1x liquidation participation

VC gets $5m, then on top of that the remaining 50% of the $25m, for a total of $17.5m

So even though there is 50/50 ownership, the proceeds are split 58/42 in favour of the VC

Capped participation: often times referred to as “capped participating preferred”

Capped participation indicates that the stock will share in the liquidation proceeds on a pro rata basis until the total proceeds reach a certain multiple of the original investment (in addition to any accrued dividends)

Example:

2x cap (1x pref) on a $5m investment that gave 50% ownership

If the firms sells for $25m, then VC’s capped proceeds would be $10m, which is $2.5m less than if they had converted to common shares and received $12.5m

Another important aspect to cover is seniority structure, if a firm has raised more than one round.

Typical or standard seniority structure follows that liquidation preference payouts are done in order from latest round to earliest round. It is more commonly referred to as First-in last-out or FILO for short. So Series B investors will get paid out in full before Series A investors receive anything.

In Pari Passu seniority preferred shareholders across all stages have the same seniority status. For pari passu payout investors will share proceeds pro rata to their capital committed in the event that there is not enough proceeds to fully cover all investors.

This gives a high-level overview with basic examples of the most common types of liquidation preferences.